22 Things Economic Developers Need to Know This Week

The stories Dane thinks you need to see. August 15, 2024 edition.

Welcome to this week's issue of What Economic Developers Need to Know This Week, where we explore the evolving dynamics of our economy.

This week we have 22 tools, stories, graphics, charts, and videos that I think you'll find informative, useful, inspiring, and perhaps even humorous. Some are economic development related directly, and some only indirectly. 🤔

If you're wondering what to do with the info in this newsletter, send something to your board members. It will make you look good!

Today's email is brought to you by Resource Development Group

RDG offers customized economic development fundraising solutions for Chambers of Commerce and Economic Development Organizations.

They are a small team with over 125 years of combined economic development fundraising experience and over $2 billion, yes, a Billion with a B, in funds raised for communities just like yours.

Every community is different. Atlanta, GA, is not Peoria, IL. Don’t use another city’s fundraising playbook, and expect the same results! A small market requires a different economic development fundraising strategy from a larger market.

RDG's experts thrive in providing customized economic development fundraising solutions for every situation. So whether you’re a startup organization or on your third funding cycle, they have the team and experience to get you the results you’re looking for.

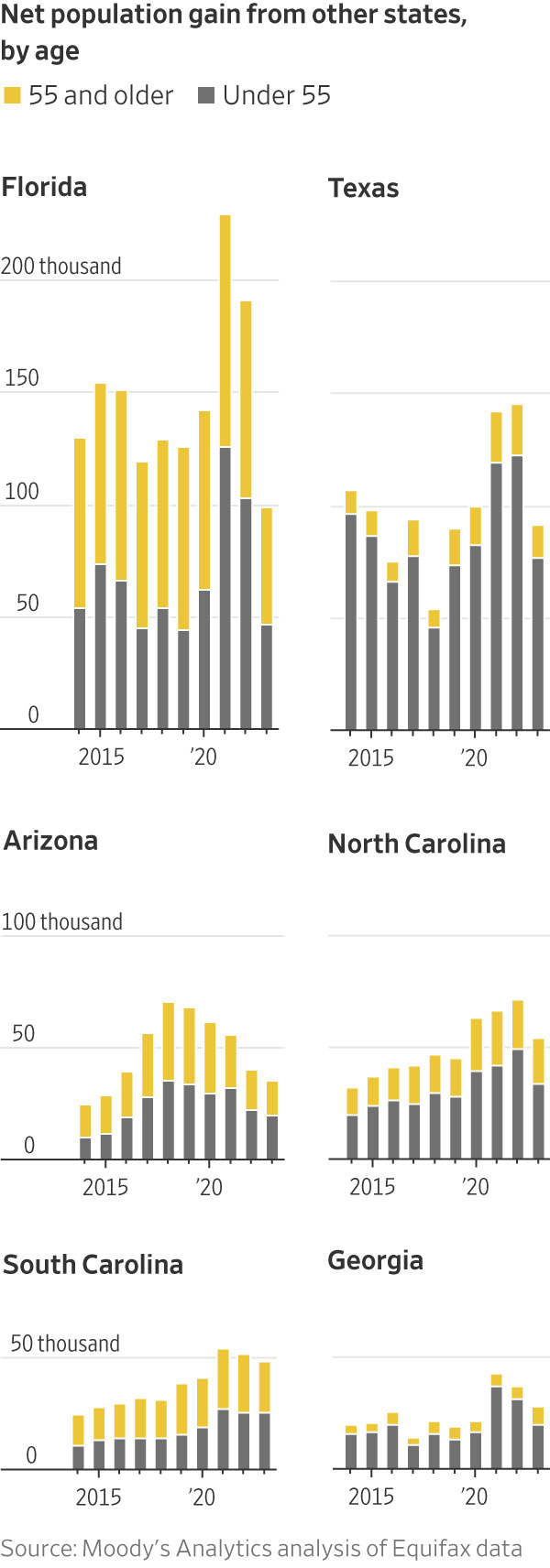

1) Texas, Florida, Arizona, Georgia and the Carolinas have gained a net half-million people who are age 55 or older from other states since 2021, according to a Moody's Analytics analysis of Equifax data. Close to half are from California, New York and Illinois.

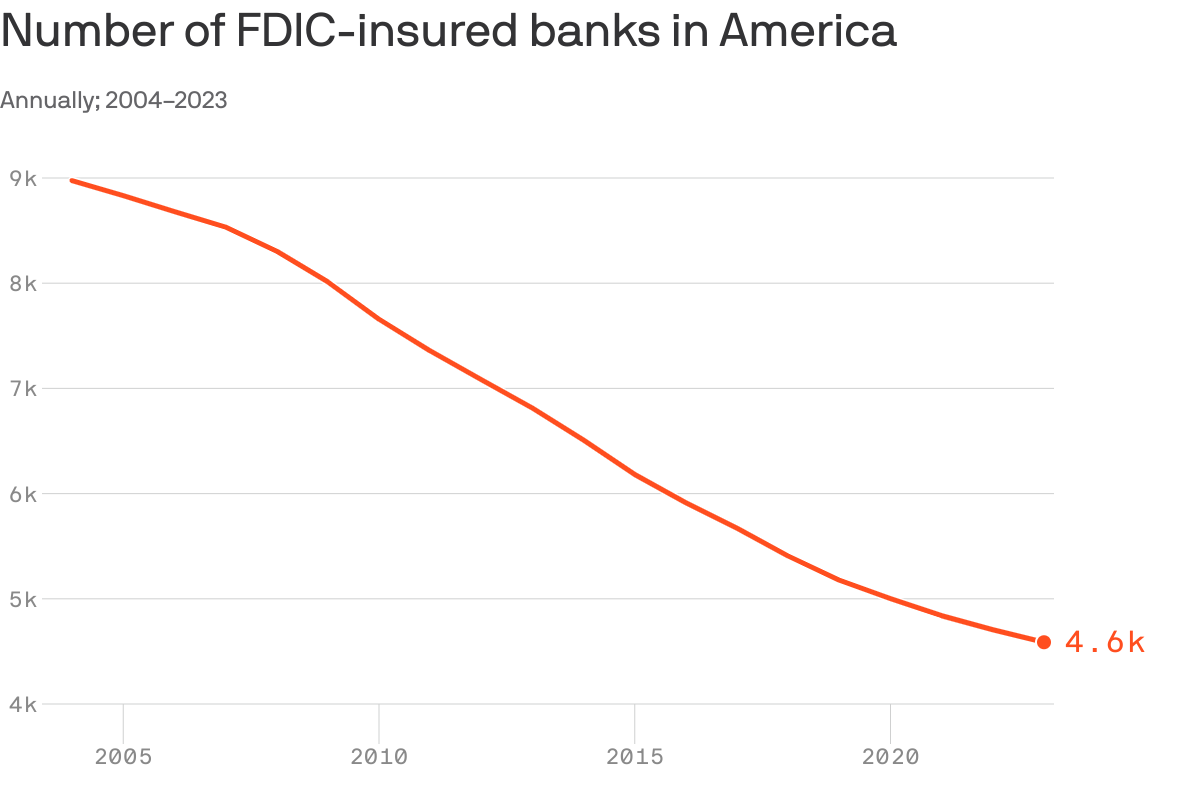

2) Credit unions are beginning to look a lot like your local bank. First some background:

The number of banks in America has been on a steady downtrend.

As the costs of technology and regulation continue to rise, smaller community banks are increasingly forced to sell out to larger acquirers – including, increasingly, big credit unions.

This is the news of the week: Nonprofit credit unions are buying record numbers of for-profit banks.

3) How To avoid three common planning mistakes from Andy Portera:

- Plans that are too long, complex, and hard to implement.

- Plans that lack innovative solutions.

- Plans that fail to encourage and prioritize action.

4) Last week: Judge Amit Mehta ruled that Google violated the Sherman Antitrust Act by excluding rivals from the general search engine market in order to maintain its monopoly. What does this mean for American business.

This decision means monopolization law is back. Exclusive contracts and arrangements are pervasive in American commerce, and until recently, executives could reliably exploit such deals without fearing that they might face any legal liability. But that era is over. This case is in the headlines, which means every single competent executive in America in any firm with market power is going to get a memo from their antitrust or general counsel on what they can and can't do going forward. And they will likely begin changing their behavior so avoid being brought to court for monopolization.

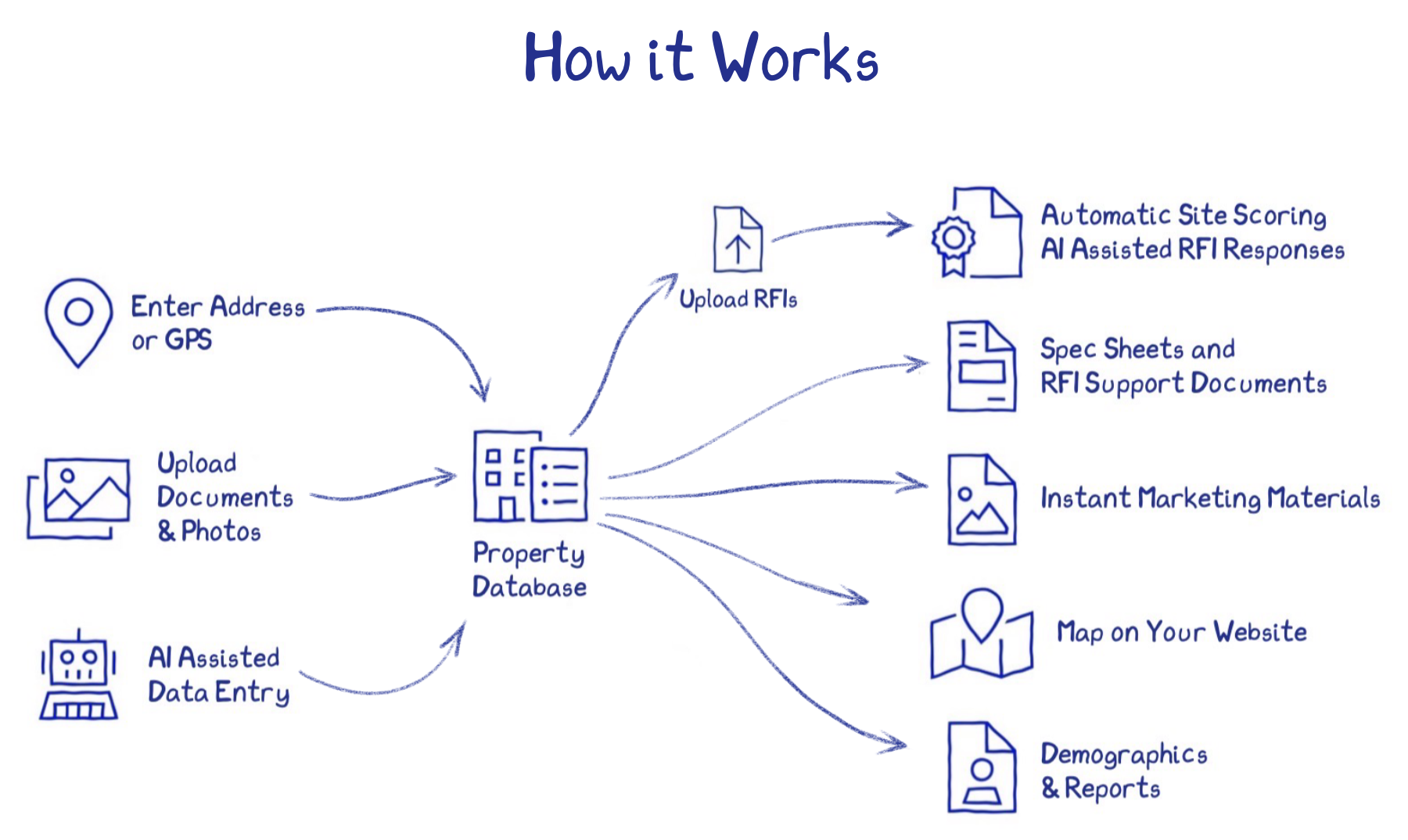

5) Sitehunt is more than a building and sites database. It also automatically responds to RFIs, creates marketing content, and so much more. Here's an overview:

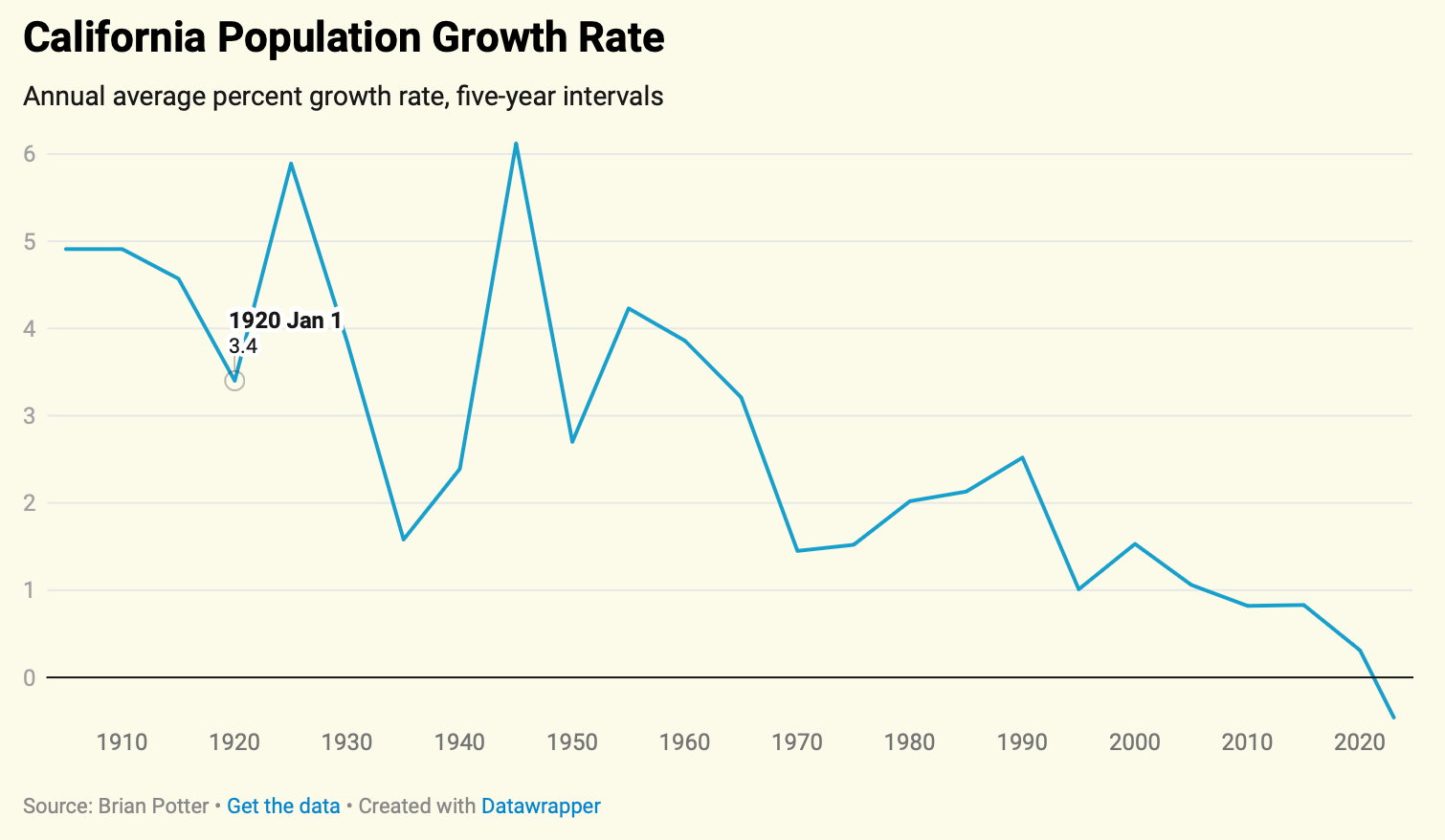

6) How California turned against growth: Even before it became a state, people migrated to California in search of a better life: for jobs, the chance to become rich and famous, or simply the comfortable climate and beautiful landscape.

But starting in the 1960s, California began to put the brakes on its growth machine. What changed?