23 Things Economic Developers Need to Know This Week

The stories Dane thinks you need to see. August 22, 2024 edition.

Welcome to this week's issue of What Economic Developers Need to Know This Week, where we explore the evolving dynamics of our economy.

This week we have 23 tools, stories, graphics, charts, and videos that I think you'll find informative, useful, inspiring, and perhaps even humorous. Some are economic development related directly, and some only indirectly. 🤔

If you're wondering what to do with the info in this newsletter, send something to your board members. It will make you look good!

Today's email is brought to you by Resource Development Group

RDG offers customized economic development fundraising solutions for Chambers of Commerce and Economic Development Organizations.

They are a small team with over 125 years of combined economic development fundraising experience and over $2 billion, yes, a Billion with a B, in funds raised for communities just like yours.

Every community is different. Atlanta, GA, is not Peoria, IL. Don’t use another city’s fundraising playbook, and expect the same results! A small market requires a different economic development fundraising strategy from a larger market.

RDG's experts thrive in providing customized economic development fundraising solutions for every situation. So whether you’re a startup organization or on your third funding cycle, they have the team and experience to get you the results you’re looking for.

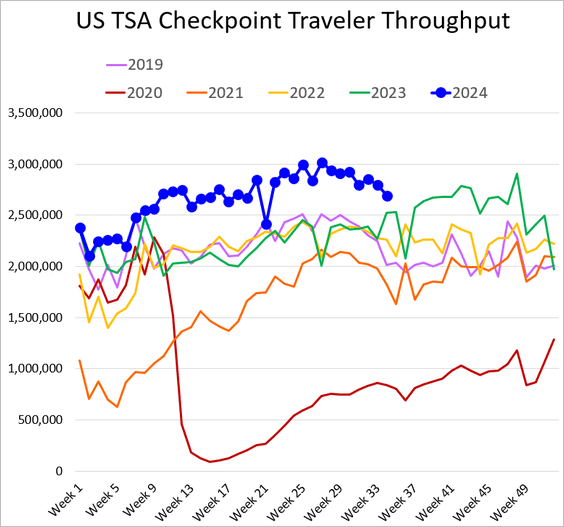

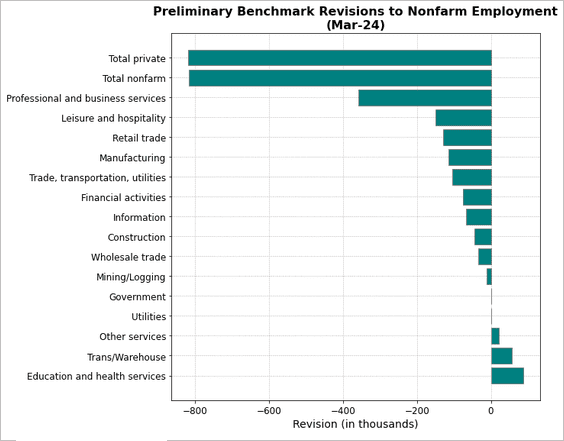

1) The widely anticipated downward revision to payrolls this week was huge:

2) What do these revised job numbers indicate? The job market is weaker than it seems, and the Fed may start cutting interest rates. Previously, they were reluctant because high employment combined with high interest rates appeared effective. However, lower employment paired with high interest rates tells a different story.

On the other hand, the lower job numbers might actually signal a positive development. If next month’s NIPA revisions leave our output measures largely unchanged, the same level of output from fewer hours worked would lead to an increase in measured productivity.

While the exact impact will be more nuanced, a 0.5% revision to payrolls could equate to a 0.5% rise in productivity.

Higher productivity could indicate that businesses are becoming more efficient, which might strengthen the economy in the long run.

3) From 2003 to 2022, average time spent at home among American adults has risen by one hour and 39 minutes in a typical day. Time at home has risen for every subset of the population and for virtually all activities.

4) Why are Texas interchanges so dang tall?:

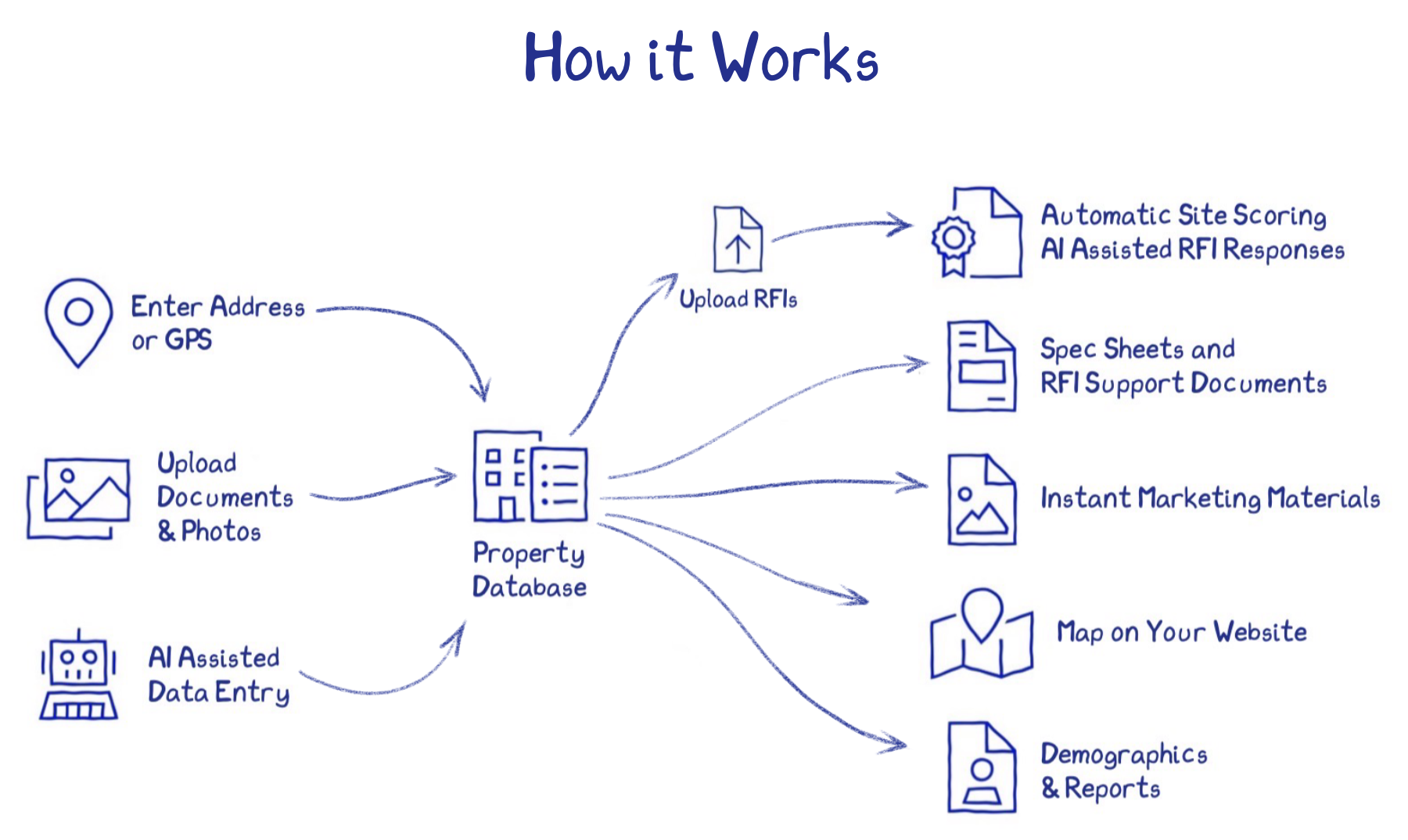

5) My software Sitehunt is more than a building and sites database. It also automatically responds to RFIs, creates marketing content, and so much more. Here's an overview:

6) Has America's potential GDP growth rate increased since the pandemic?

Eric Wallerstein, chief markets strategist at Yardeni Research, says yes:

Our answer is "yes." This aligns with our views that: (1) strong immigration flows and record-high labor-force participation are growing the labor force (hence, the rise in the unemployment rate despite a healthy jobs market); and (2) productivity growth will boom over the rest of the decade as a result of widespread adoption of technologies like AI, automation, and robotics (as companies will need to augment their workforces with high tech despite the growing labor force).

Wallerstein suggests in a new research note that the American economy's potential GDP may be closer to 4.0 percent, significantly higher than the Federal Reserve's long-run forecast of 1.8 percent.

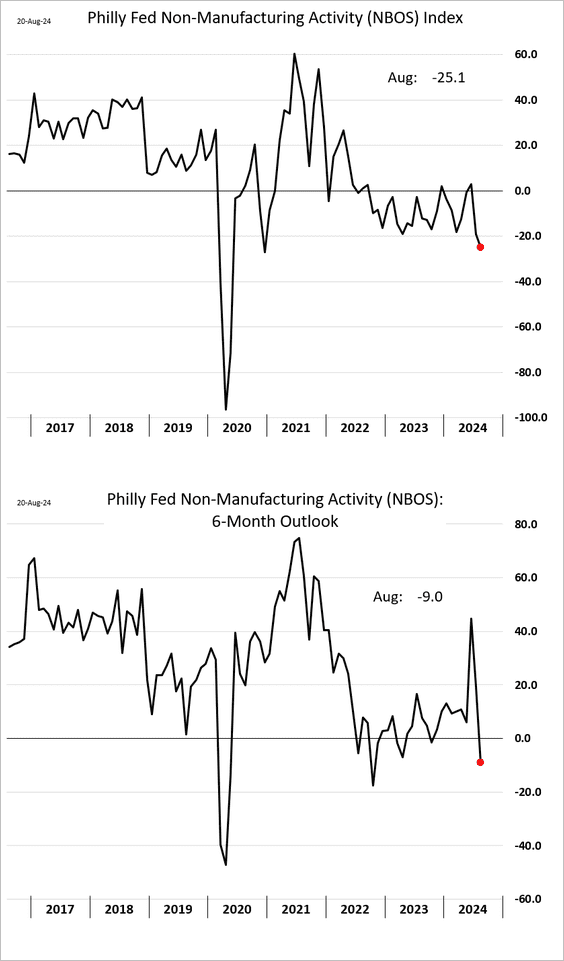

7) In other news, the Philly Fed's regional services index indicated weakening business activity in August:

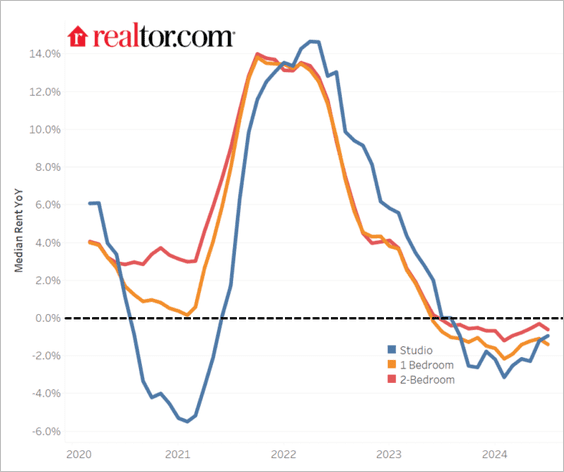

8) The median asking rent remains below last year's levels:

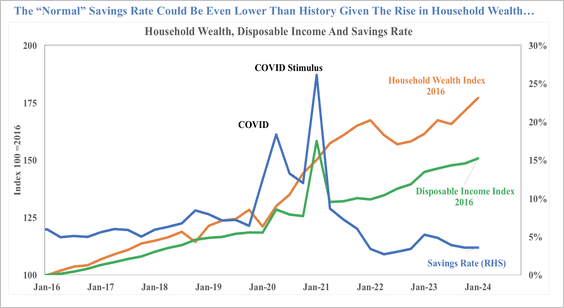

9) Household wealth and disposable income continue to rise while the savings rate slows:

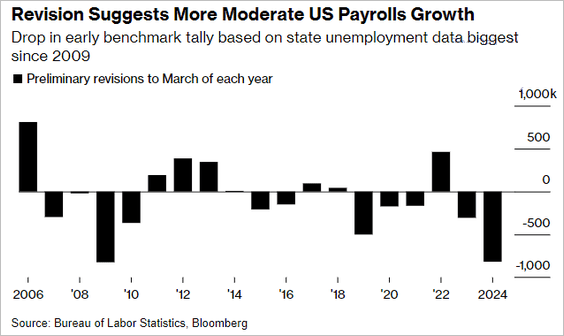

10) Despite depressed consumer sentiment, air travel is at record highs: