23 Things Economic Developers Need to Know This Week

The stories Dane thinks you need to see. January 15, 2026 edition.

Welcome to this week's issue of What Economic Developers Need to Know This Week, where we collect links, charts, and ideas about the economy and place.

This week: 23 stories, graphics, and rabbit holes that are (mostly) relevant to economic development — and occasionally just funny.

If you're wondering what to do with the info in this newsletter: forward one item to a board member or elected official. It makes you look prepared.

Today's email is brought to you by Resource Development Group

Founded in 1995, RDG offers customized economic development fundraising solutions exclusively for Chambers of Commerce and Economic Development Organizations. That’s their niche. That’s their specialty.

Their highly experienced team has raised over $2 billion -- yes, that’s $2 billion with a “B” -- for communities of all sizes and organizations just like yours.

Every community is unique. Tulsa, OK, is not Maury County, TN. Atlanta, GA is not Detroit, MI. Chattanooga, TN is not Charlottesville, VA. Don’t use another community’s fundraising playbook and expect the same results!

RDG's experts excel in providing customized economic development fundraising solutions for every situation. So whether you’re a single county EDO ready to kick off your first fundraising campaign or a large regional organization on your third funding cycle, they have the team and experience to get you the results you’re looking for.

1) Economic Development and Developers in the News # 226 - Econ dev news from 62 economic development executives and organizations in 23 states.

2) Podcast 204: From Company Town to Community Vision with Jessica Huble - When the City Has to Buy the Factory

3) 24 New Economic Development Jobs This Week - From $41,434 - $225,437

4) 2025: A Year in Podcasts - 2025's economic development people, strategies, ideas, and insights

5) Podcast 203: Transit as Economic Development Strategy with Joya Stetson - The workforce pipeline called, it wants a bus stop.

6) Must read: The Ghost of Slavery: a four-part history of Southern economic development - A bracing look at how slavery (and its afterlives) shaped the modern economy of the South, and what that means for practitioners today.

Read in order:

- Part One (1776–1865): “Southern Economic Development in Chains”

- Part Two (1865–1940): “New South”, “New Deal”, Old Exclusions

- Part Three (1940–1980): Breaking the Chains

- Part Four (1980–2025): Rise of the Sun Belt

About the author: Sam Blatt is a certified economic developer (with 10+ years in the field) who writes the Substack Ambitious Abundance about building broad-based community wealth through economic development and public policy. He’s Georgia-born, works across the Southeast, and he’s clear that these essays reflect his personal views, not those of his employer.

Why these are important for economic developers: Blatt’s core argument is that you can’t understand the South’s modern economic geography, or its persistent workforce challenges, without treating slavery and segregation as economic systems that shaped industry structure, infrastructure, human capital, migration, and political institutions. Across the series he connects big historical “why” questions to the day-to-day work of local practice: how exclusion and extractive growth can produce impressive topline numbers while hollowing out long-run prosperity; how public investment (from rail and electrification to defense spending and research infrastructure) creates path dependency for decades; and why “business friendly” strategies that fixate on low costs can trade away the very thing communities compete on now, talent.

If you work in business attraction, incentives, or workforce, this is also a useful mirror. The essays push you to ask uncomfortable-but-necessary questions: Who is this development for? Who bears the downside? Do our metrics capture household stability (healthcare coverage, wealth-building, mobility), or just job counts? Are we building an ecosystem with local ownership, or facilitating profit leakage? Even if you don’t agree with every conclusion, the series is a rare piece of economic development writing that treats history as a live variable in today’s strategy.

7) Cancun: a government-built “dollar-extraction machine” — A reminder that some “market successes” are engineered infrastructure + positioning: Mexico used data, upfront infrastructure investment, and a deliberately frictionless visitor experience to turn a sandbar into a global tourism export.

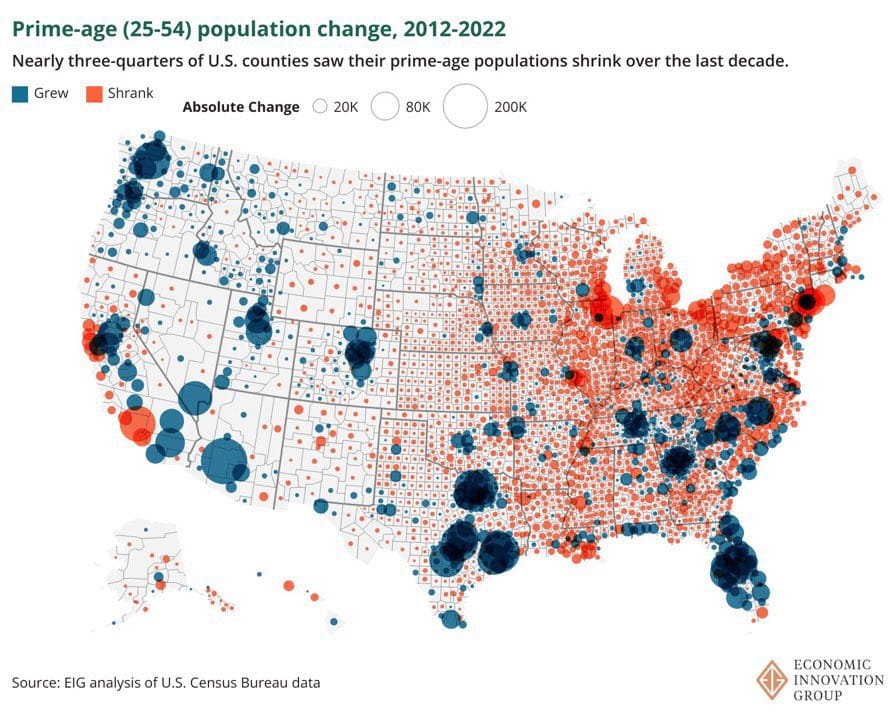

8) Small towns → cities (and usually not back) — Outmigration is the default; retention takes intentional work.

The Econ Dev Show is made possible by Sitehunt.

Sitehunt (created the Econ Dev Show's host Dane Carlson) will not replace your relationships, manage your BR&E visits, or do your board politics. It will not invent workforce where none exists, and it will not make you sound smart after one login. Wit and wisdom are still on you.

But if you care about your buildings and sites, and getting the RFI out the door with confidence, Sitehunt may be the smartest small investment you make this year.

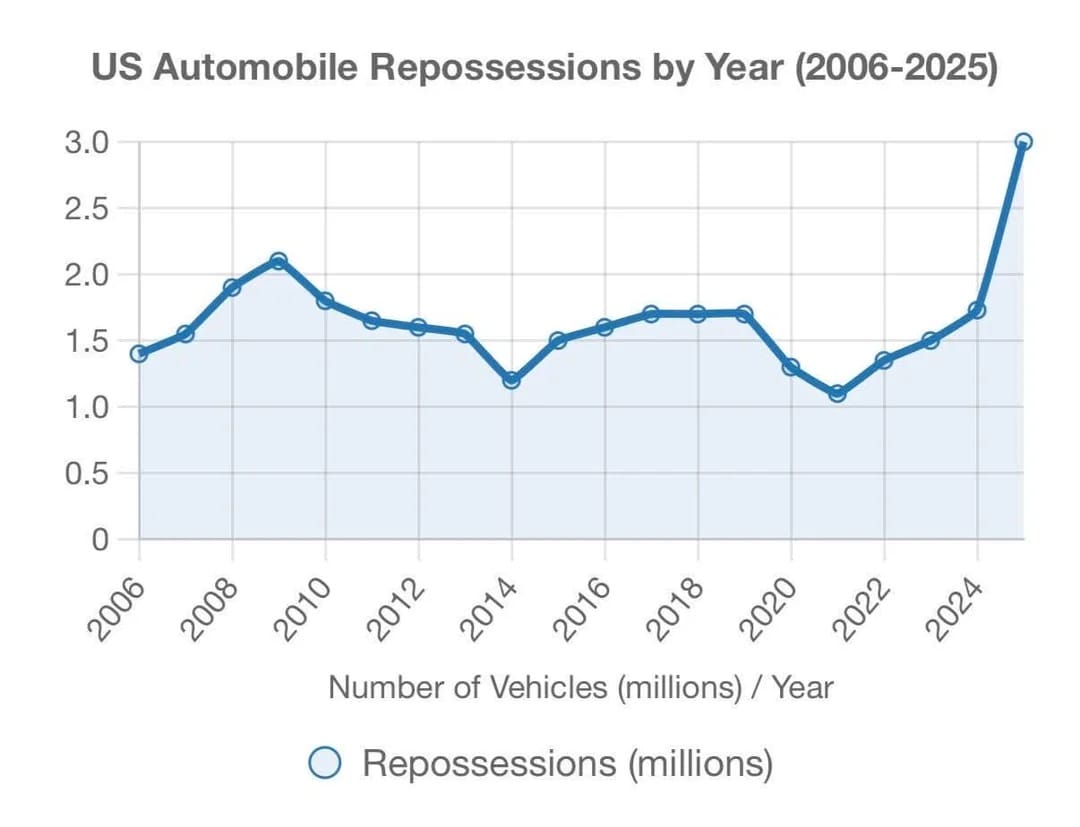

9) US automobile repossessions (2006–2025) — If the 2025 spike holds, it’s an economic stress signal worth watching.

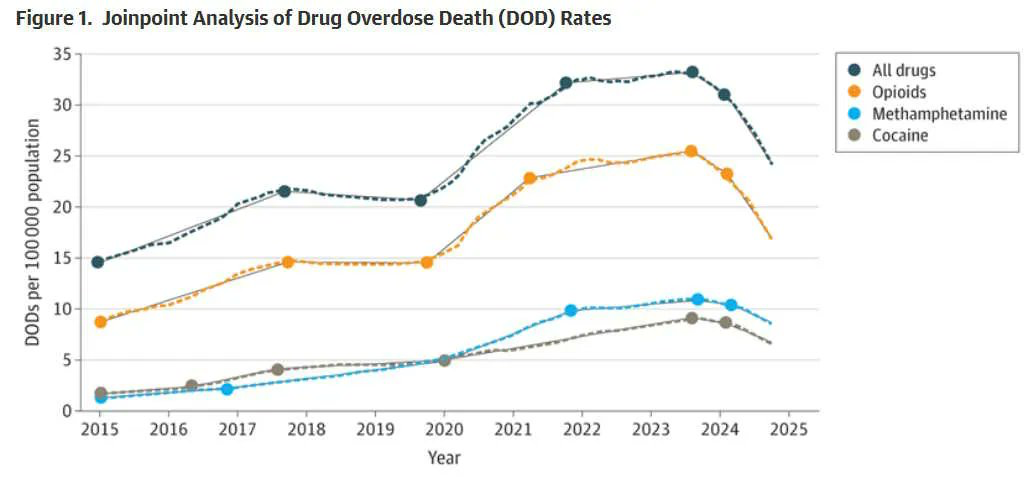

10) Drug overdose death rates (2015–2025) — The chart suggests a recent downturn after a 2022–2024 peak (across substances).

11) Prediction: 2026 word of the year: “Hyperlocal” — Walkability + third places + neighborhood networks are becoming a mainstream demand.

12) Resisting tech isn’t the threat — the second-order effects are — Adoption changes workflows, pricing, and competition (even if the tool itself feels minor).

How's this relavent to you, the economic developer? Watch this: Proptech is Dead! The Past & Future of Cities and Buildings.

13) Mega-projects fail loudly; incremental change works quietly — For cities, “singles and doubles” compound faster than waiting on a home run.

14) Meme break:

15) Top Risks of 2026: A useful annual scan of geopolitical risk for scenario planning.

Report: Eurasia Group — Top Risks 2026

16) Evolutionary economics + path dependency (Jim Gibson) — Two frameworks for thinking about how local economies evolve (and get stuck).

Read: Evolutionary Economics and Breaking Path Dependency

17) Sarasota County’s tech economy is no accident — A simple play: make the ecosystem legible and build institutions around it.

18) Why Tesla might save small towns — EV charging reintroduces “time” into travel — a chance to rebuild local roadside economies.

19) Rural America was revived. It won’t happen again. | Opinion — A (debatable but important) argument about how policy shifts could reverse rural momentum.

20) Deadhead Economics: what the Grateful Dead knew about local economic development

21) The Futile Campaign to Get People to Dress Better on Planes (WSJ) — Apparently, “air rage” now has a wardrobe theory.

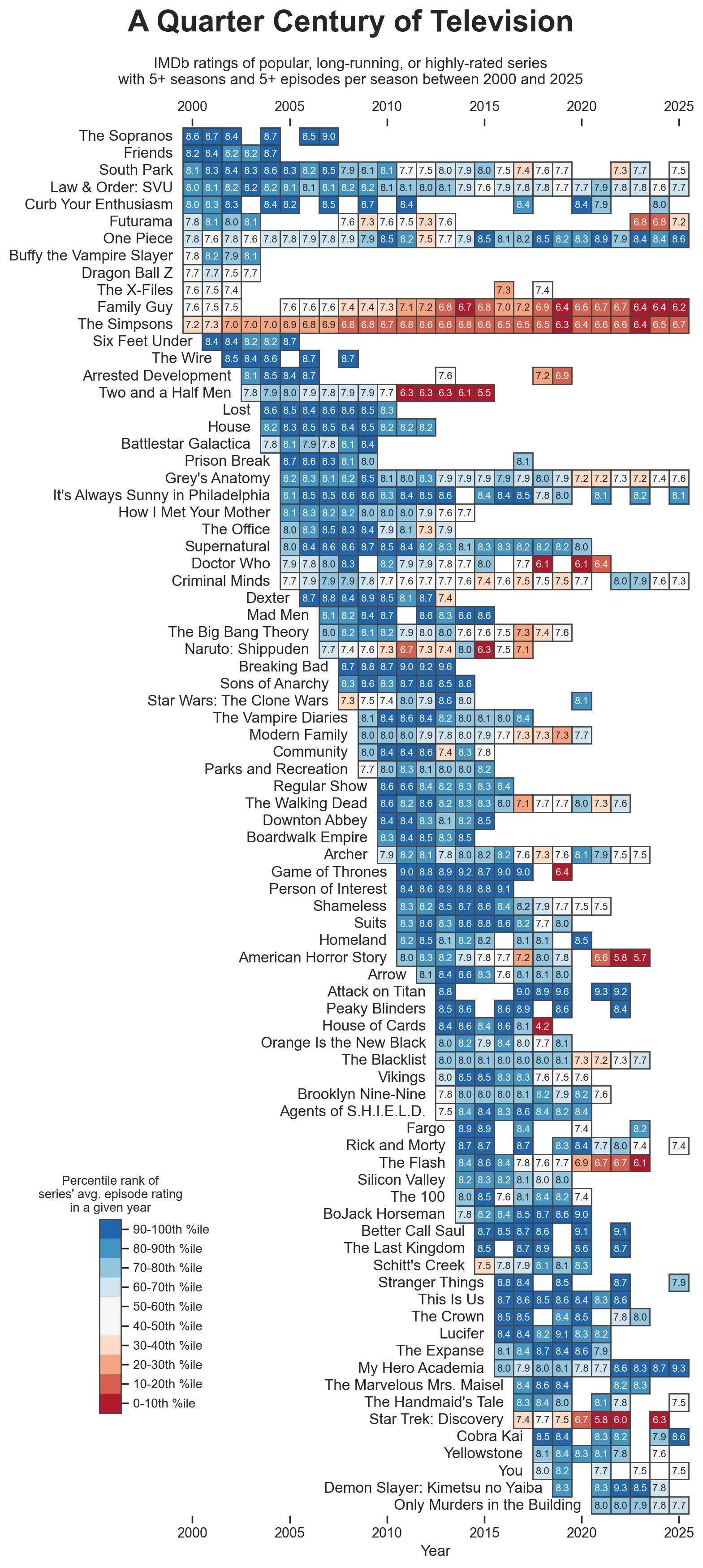

22) A quarter century of television — A dense (and addictive) IMDb ratings history of popular shows, season by season (2000–2025).

23) The geography of choice in 2020s America — Green counties gained people (net domestic migration); purple counties lost them.

Americans are moving away in droves from three places: the Mississippi Delta, the western Great Plains, and California.