36 Things Economic Developers Need to Know This Week

The stories Dane thinks you need to see. May 22, 2025 edition.

Welcome to this week's issue of What Economic Developers Need to Know This Week, where we explore the evolving dynamics of our economy.

This week we have 36 tools, stories, graphics, charts and videos that I think you'll find informative, useful, inspiring, and perhaps even humorous. Some are economic development related directly, and some only indirectly. 🤔

If you're wondering what to do with the info in this newsletter, send something to your board members. It will make you look good!

Today's email is brought to you by Resource Development Group

Founded in 1995, RDG offers customized economic development fundraising solutions exclusively for Chambers of Commerce and Economic Development Organizations. That’s their niche. That’s their specialty.

Their highly experienced team has raised over $2 billion -- yes, that’s $2 billion with a “B” -- for communities of all sizes and organizations just like yours.

Every community is unique. Tulsa, OK, is not Maury County, TN. Atlanta, GA is not Detroit, MI. Chattanooga, TN is not Charlottesville, VA. Don’t use another community’s fundraising playbook and expect the same results!

RDG's experts excel in providing customized economic development fundraising solutions for every situation. So whether you’re a single county EDO ready to kick off your first fundraising campaign or a large regional organization on your third funding cycle, they have the team and experience to get you the results you’re looking for.

1) Economic Development and Developers in the News # 196 - Econ dev news from 74 economic development executives and organizations in 32 states.

2) Podcast 174: Building a Regional Brand: Kansas City's Marketing Success with Jonathan Knecht - Why make a new logo when your community already has one?

3) Sitehunt: Retail Logo Maps - Now rolling out a new feature to complement our property intelligence capabilities.

4) 18 New Econ Dev Jobs This Week - In 14 states, from $35,090 - $225,000.

5) 25 Things Economic Developers Need to Know This Week - The stories Dane thinks you need to see. May 15, 2025 edition.

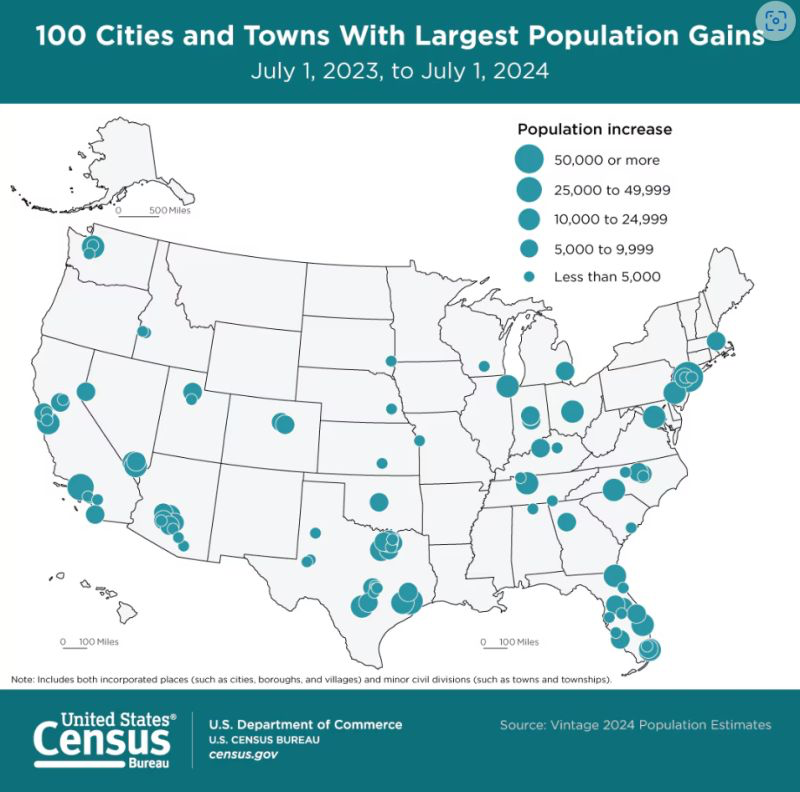

6) The 2024 population estimates released this week by U.S. Census Bureau. Here are the top 10 cities above 500,000 or more residents ranked by percentage growth:

- Charlotte, 2.55%

- Fort Worth, 2.38%

- Seattle, 2.20%

- Washington DC, 2.17%

- Las Vegas, 1.84%

- Houston, 1.84%

- Jacksonville, 1.65%

- San Antonio, 1.59%

- Nashvillemetro, 1.54%

- San Jose, 1.39%

7) Good quick read on marketing your community: Talent Is the Target: Rebranding Communities to Deliver the Workforce to Support Reshoring

8) Good long read on how philanthropy elevated regions' capabilities in a period of federal investment, and lessons for what comes next: Foundations of regional economic transformation

9) Interesting read with lots of charts: So why did U.S. wages stagnate for 20 years? Turns out, there are theories, but no real answers.

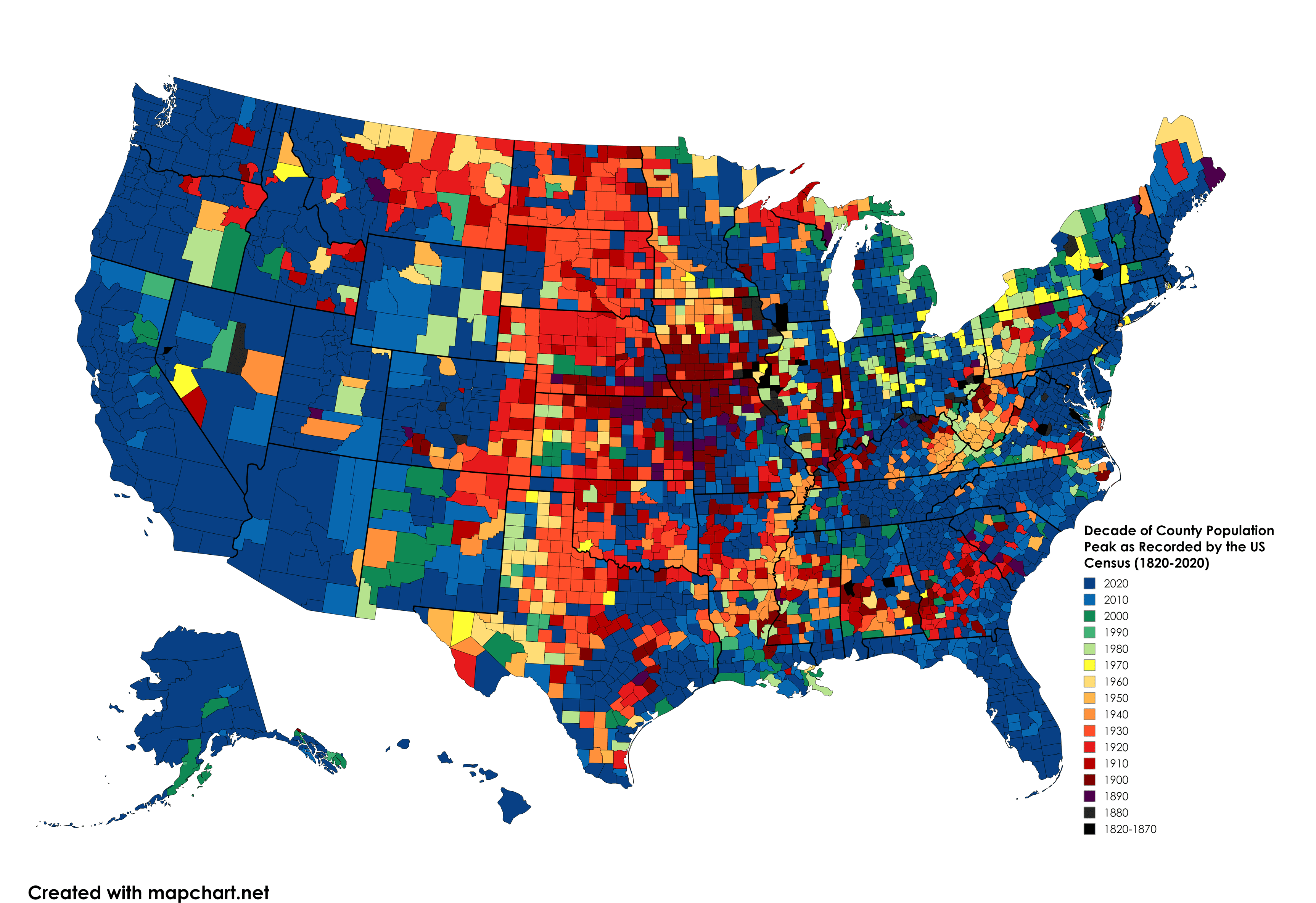

10) The decade every US county peaked in population as recorded by the US Census (1820-2020):

Today's issue is brought to you by Sitehunt.

Sitehunt is the AI-powered platform transforming how economic developers manage site selection and respond to RFIs.

Whether you're chasing leads, showcasing inventory, or competing for big wins, Sitehunt gives you the intelligence and agility to move fast, impress prospects, and close deals. It’s not just smarter software: it’s how modern economic development gets done.

11) What does site readiness for rail-served industrial development look like?

12) What happens when a town without zoning decides that they don't want a data center after construction has already started? The Data-Center Wars Arrive in Small-Town West Virginia

13) When a factory closed in a small town what happened to the empty buildings?

14) I built this for Sitehunt, but you can use it too: Free Retail Logo Map Generator. Use it to create a custom map showing major retail businesses in your community.

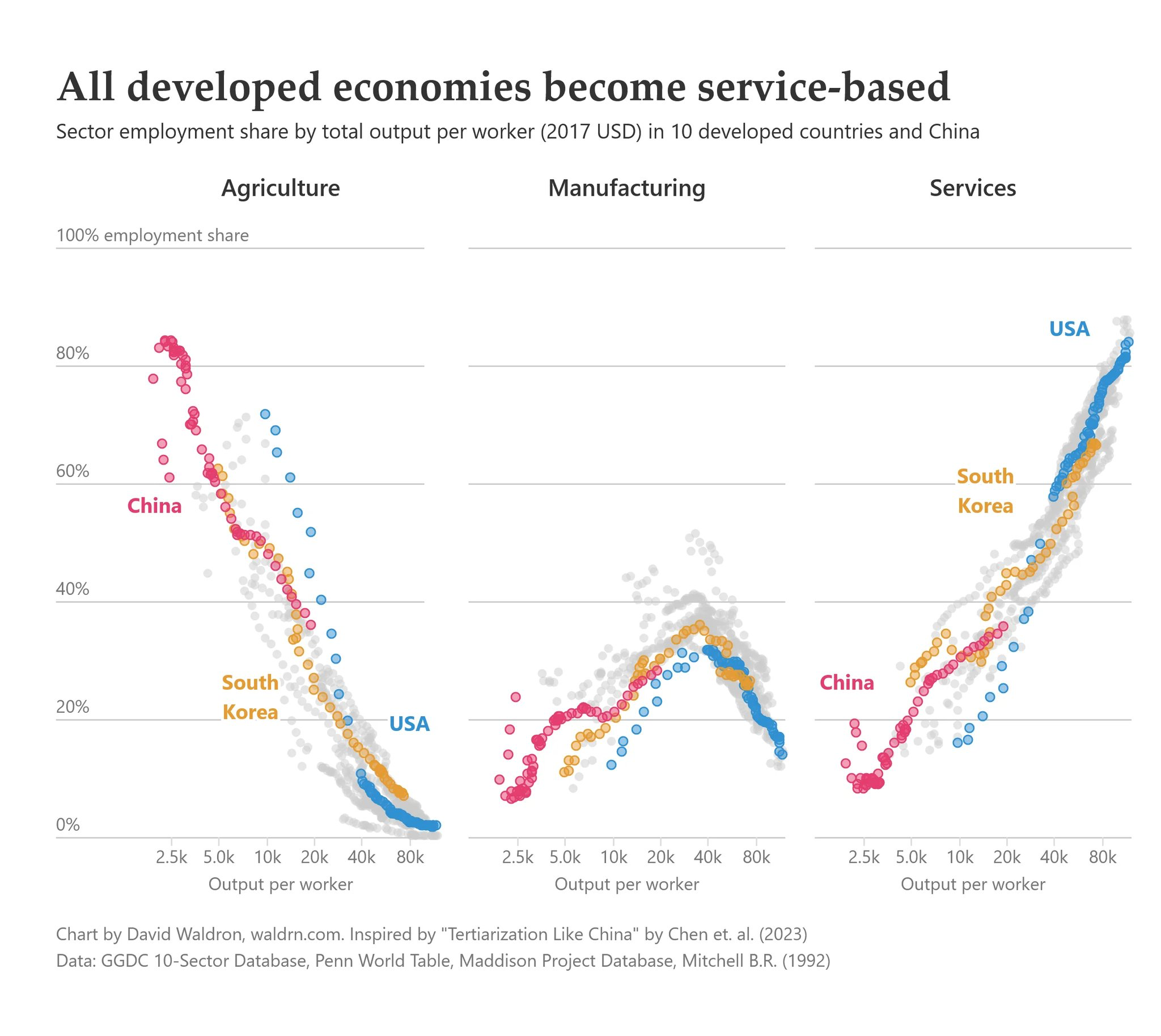

15) All developed economies eventually become service-based:

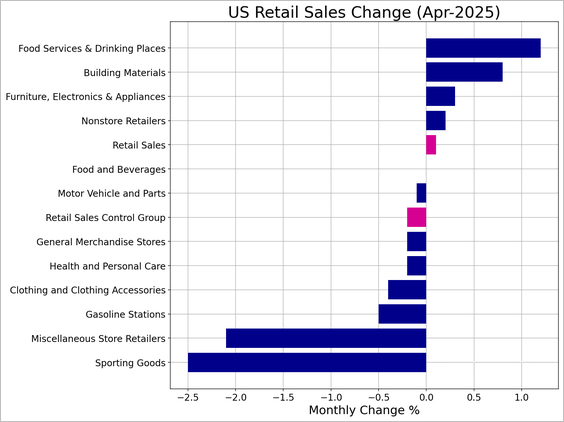

16) U.S. retail sales growth slowed sharply in April as the boost from households front-loading motor vehicle purchases ahead of tariffs faded and consumers pulled back on spending elsewhere against the backdrop of an uncertain economic outlook.

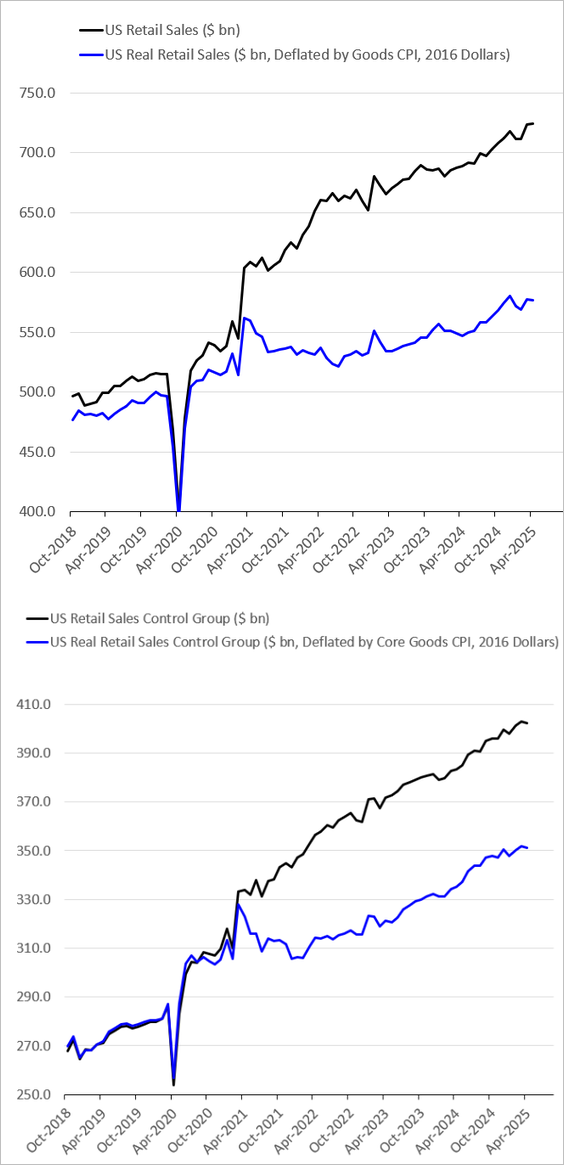

17) Here are the trends in nominal and real retail sales (levels):

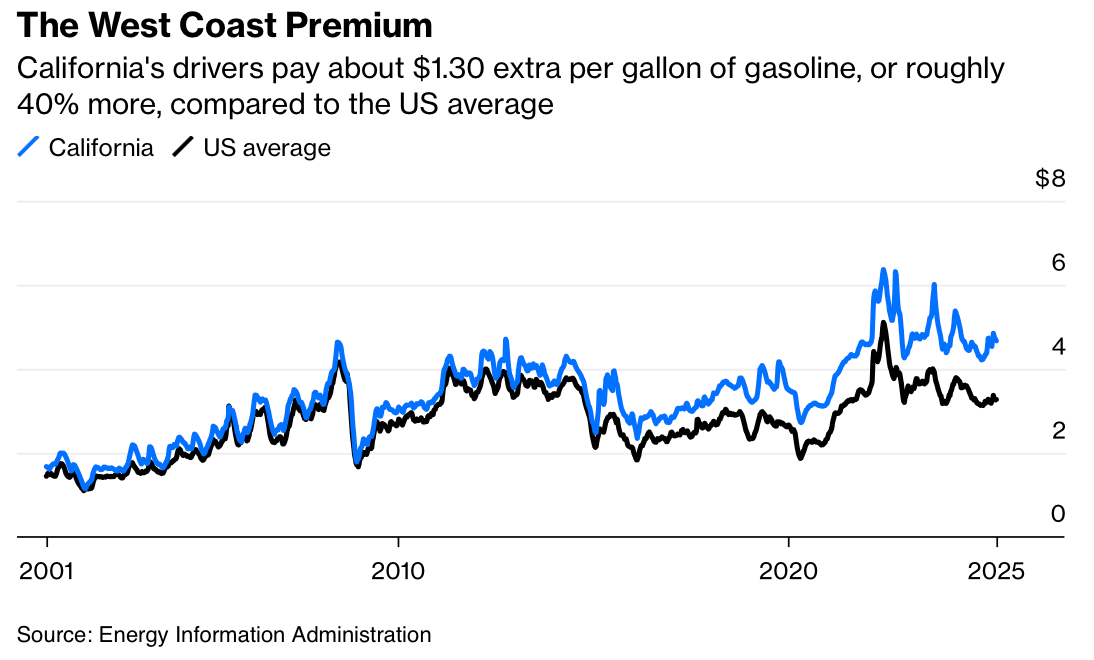

18) Gasoline prices in California vs. the US average:

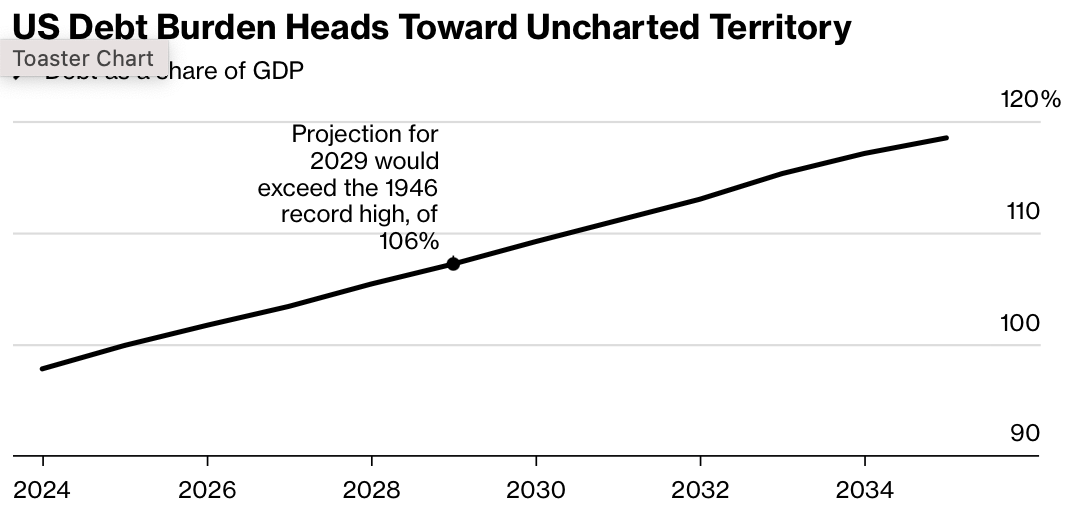

19) US debt is on an unsustainable trajectory:

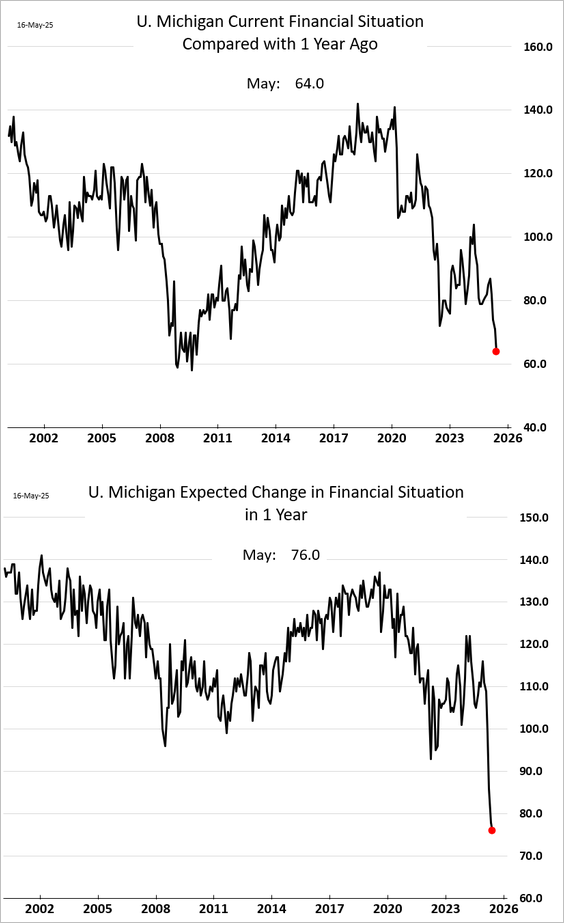

20) Americans are worried about their financial situation:

21) Inflation expectations climbed further:

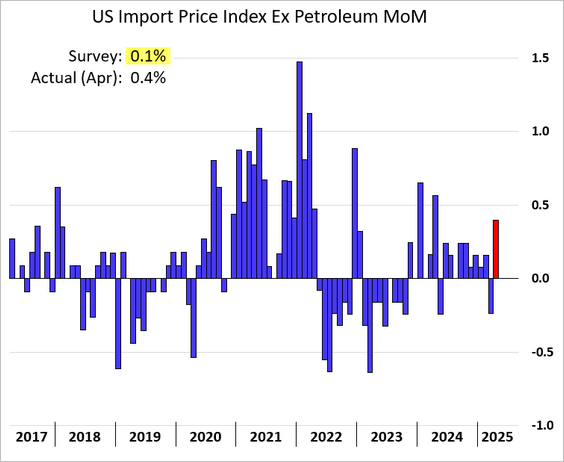

22) US import prices jumped more than expected in April. This index reflects the prices of goods as they arrive at the US border before tariffs, duties, or taxes are applied:

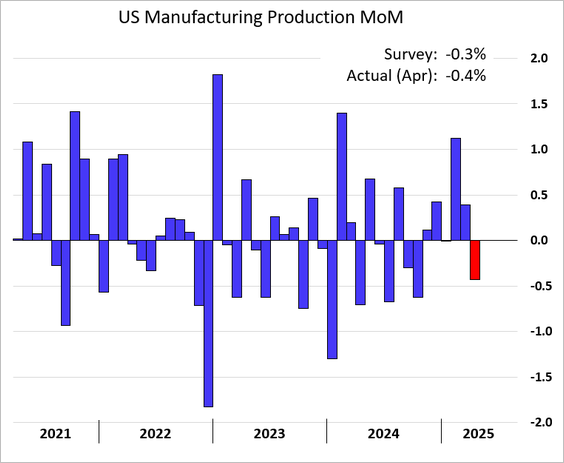

23) US manufacturing output slowed in April:

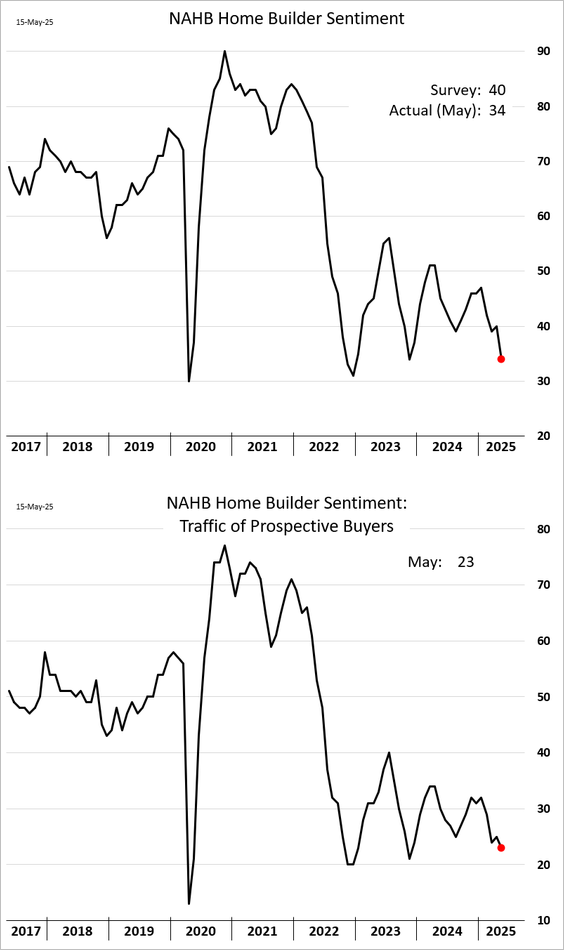

24) Homebuilder sentiment declined this month: