Assorted Links Friday

Diesel, community college, jobs, Amazon, recession, the future, retail, supply chains, housing, and thankfully "Tetris tames trauma".

Table of Contents

Diesel stockpiles are at a 20-year low as US heads into winter: Current stockpile covers only 31.2 days of demand.

Dean Barber: Community colleges can fill the bill.

How playing Tetris tames trauma: Last week a group of researchers from the UK and Sweden published a study reporting that playing just 20 minutes of Tetris — in research parlance, a "Tetris-based intervention" — following an automobile accident can help prevent the formation of the painful, intrusive memories that can follow trauma.

US job growth falls to slowest pace of year: Economy added just 194,000 jobs while unemployment rate dropped to 4.8% as many workers exited from labor force

Amazon CEO, citing ‘rougher’ patch with Seattle, looks to ’burbs: Amazon.com Chief Executive Officer Andy Jassy is open to a reset in his company’s sometimes-contentious relationship with Seattle, but made clear that he’s hedging his bets with plans to expand in neighboring cities.

US is in recession if history of consumer sentiment repeats: A decline in consumer expectations suggests the U.S. economy is in recession even though employment and wage growth indicate otherwise

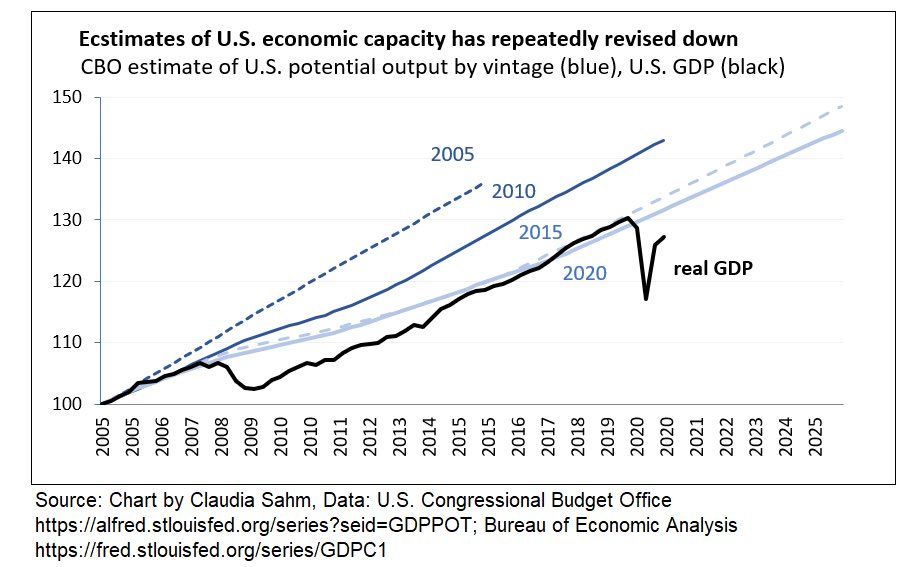

The future is getting farther away:

If total factor productivity had continued to grow at its 1957 to 1973 rate then we today would be living in the world of 2076 rather than in the world of 2014.” Sadly, the future is continuing to recede. Consider the graph below. If growth had continued at the rate expected by the CBO in 2005 then we today would be living in the world of 2037 rather than in the world of 2021."

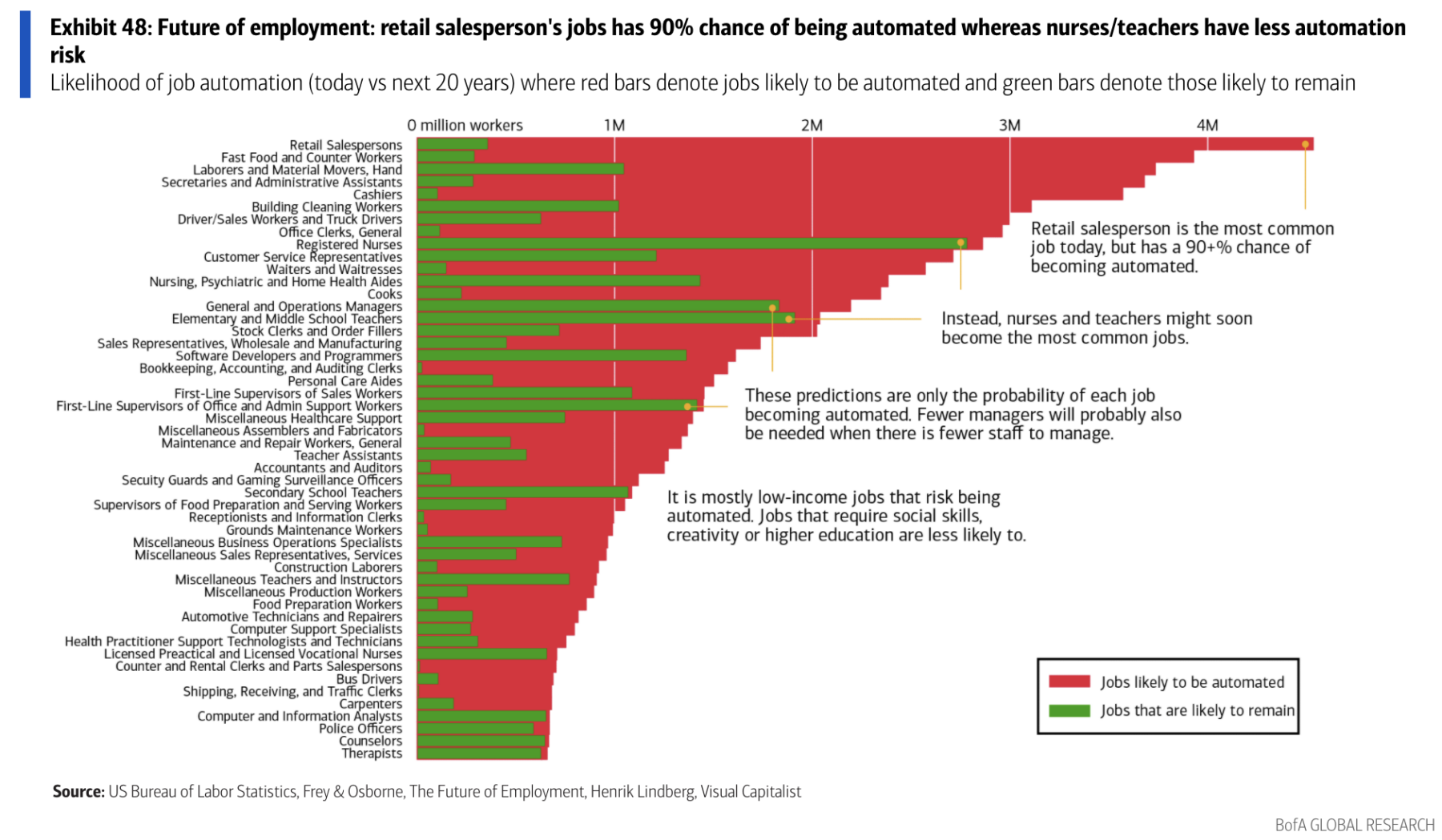

The future of retail:

Supply chain havoc is getting worse — just in time for holiday shopping: The most popular holiday gifts might not arrive in time for the holidays, even if you order now.

Are US housing prices becoming unaffordable?

Housing prices are rising for a number of reasons: Household formation from the millennial generation, Increased demand to move due to the pandemic, Investors looking for yield and inflation protection, Extremely low mortgage rates. The one variable that could throw a wrench into this equation would be higher mortgage rates.

Econ Dev Show Newsletter

Join the newsletter to receive the latest updates in your inbox.