Assorted Links Thursday

Amazon, Texas, LinkedIn, books, renting, leverage, community, the Fed, shortages, optimism, dollar stores, luxuries, inflation, and more.

Table of Contents

Happy July, everyone! Can you believe that we're already halfway through 2021?! I can't.

It seems like just the other day, it was still early March 2020. I'd just turned 44, and everything was going just swell, but then my wife started coming back from Costco with the entire rear of her SUV packed with meat. Lots of meat.

Then it was an entire carload of coffee, chocolate, and pasta. I didn't mind. Perhaps, she was planning a party.

She showed me the "painter's masks" she'd purchased at Lowes and Home Depot in between her trips. Were we planning a home improvement project? And why was she showing off damaged packages of face masks she'd bought. Who buys those? She surely didn't – I'd thought.

But then it was carloads of rice, flour, beans, and toilet paper. And then her shopping stopped, and almost immediately, the stores were empty of pretty much everything I now had in my overflowing pantry.

And then an entire year and a half happened, and now I'm 45, and it's July. Do you feel like this?

Thanks for reading this issue of the Econ Dev Show blog. Please share this with a friend in the econ dev biz.

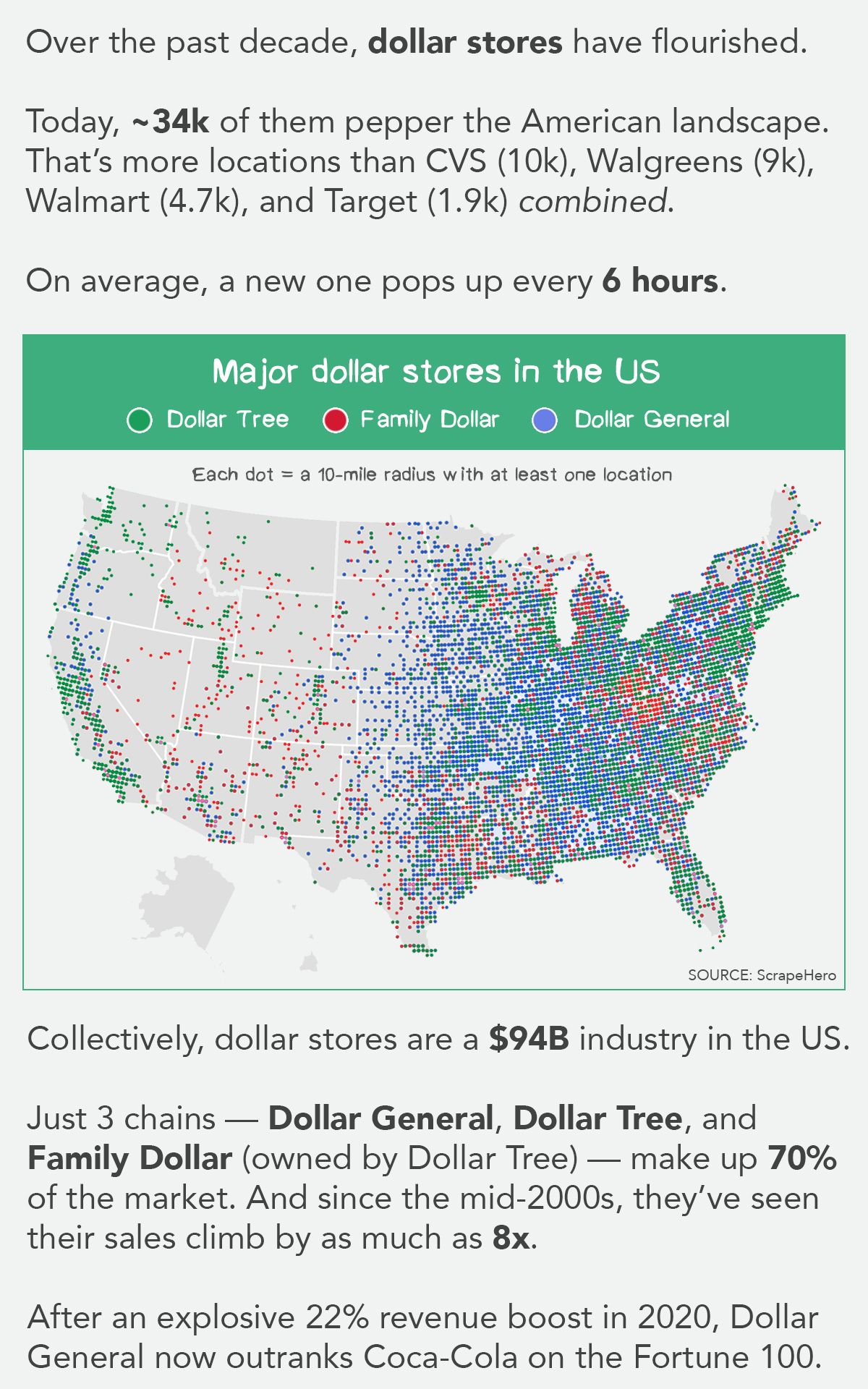

The economics of dollar stores: A visual explainer of the numbers behind America’s ubiquitous bargain-basement chains.

The LinkedIn Economic Development Newsletter June 2021 edition by Andrew Phillips of LinkedIn is out.

Amazon demands one more thing from some vendors: Certain suppliers are asked to give Amazon the right to buy shares at potentially lower-than-market rates as part of their contract.

Texas led nation in FDI, employment in 2020: Foreign investors continued to be interested in acquiring, starting and expanding businesses in the United States despite the COVID-19 pandemic, and Texas led the nation in FDI in 2020, according to a July 1 report by the U.S. Bureau of Economic Analysis.

How lasting are the economic consequences of pandemics? 220 years of Swedish experiences.

What I'm reading to get better at interviewing podcast guests: Book of Questions by Gregory Stock.

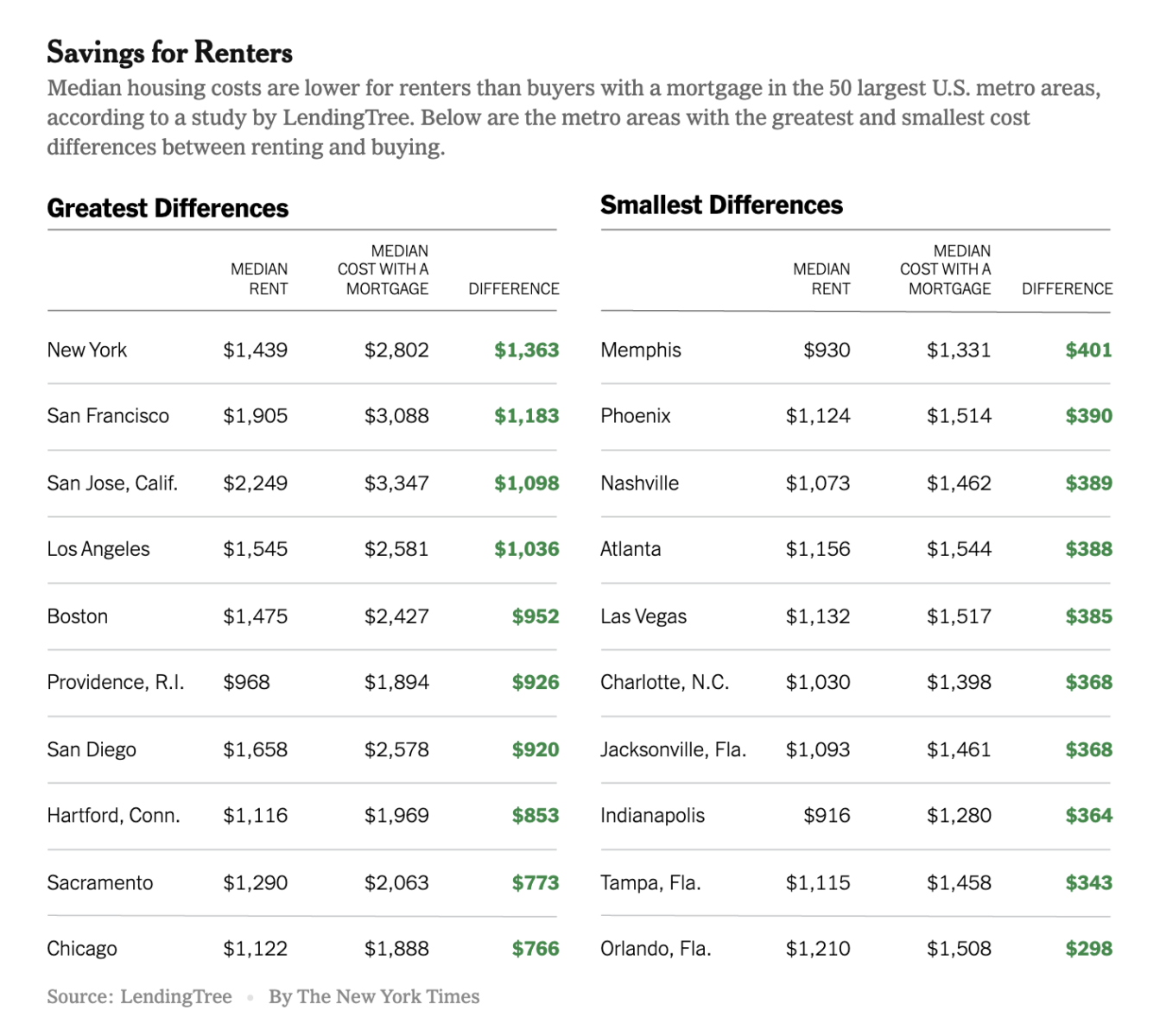

Renting is cheaper than buying, almost everywhere

Workers are gaining leverage over employers right before our eyes: “Employers are becoming much more cognizant that yes, it’s about money, but also about quality of life.”

The psychological benefits of commuting to work: Many people who have been working from home are experiencing a void they can’t quite name.

The coronavirus pandemic plunged Americans into recession. Instead of emerging poorer, many came out ahead: U.S. households added $13.5 trillion in wealth last year, according to the Federal Reserve, the biggest increase in records going back three decades.

Commodity traders harvest billions while prices rise for everyone else: From oil to steel, raw material prices are surging. As the world economy recovers, how much further does the boom have to run?

Seven reasons to be extremely optimistic about the economy right now:

But if you look past the near-term wobbliness and pay close attention to the data that have been trickling in lately, there are ample reasons to be optimistic about where the economy is headed. It’s reasonable to think that by this year’s holidays, the long-predicted Biden boom will really be roaring, and the economic pain of the coronavirus crisis will finally be behind us. Here are seven reasons why.

Now that the Covid panic is starting to subside, the "boom" is beginning. Especially in the luxury goods market: Welcome to the "post-COVID luxury spending boom"

My recent podcast episodes that I know you've missed:

- From the West Coast to the East Coast with Patrick Pierce

- How to Save Your Downtown with Small-Scale Manufacturing with Ilana Preuss

- Economic and Workforce Development with Cody Mosely

- What's a Community Development Improvement Corporation with Josh Mejia

- Your EDO Needs a Podcast (or Two) with Chad Chancellor

- From Econ Dev, to a Startup, and Back Again with Shad Burner

- Inter-Tribal Economic Development with Rebecca Naragon

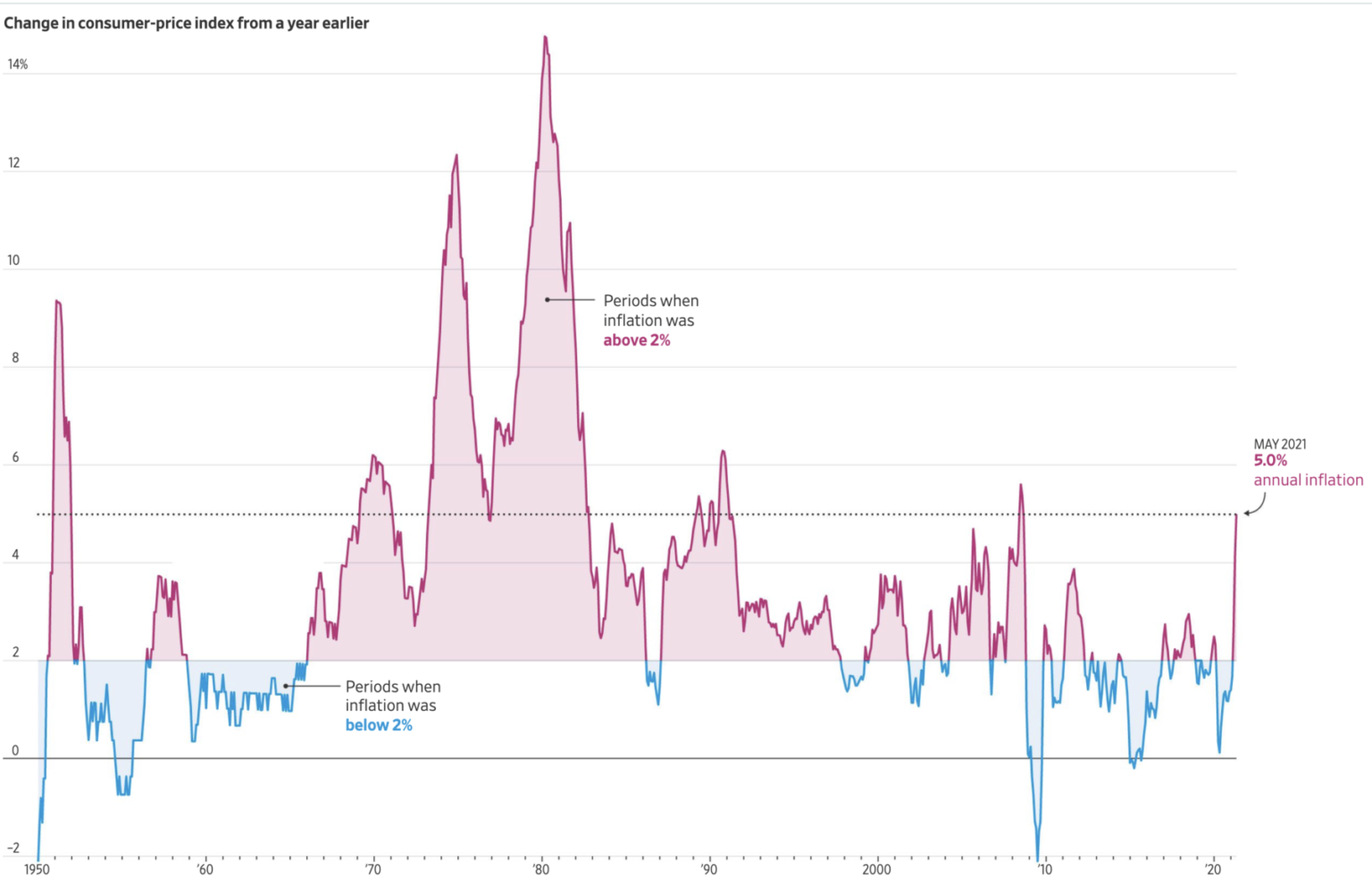

Our inflation looks less scary on this chart from the Wall Street Journal:

Econ Dev Show Newsletter

Join the newsletter to receive the latest updates in your inbox.