The 56 Things Economic Developers Need To Know This Week

The stories that Dane thinks you need to see from this week. May 18, 2022 edition.

Welcome to the "make you a smarter economic developer" newsletter! Thanks for spending a few minutes with us this morning.

Today we have 56 stories, graphics, charts, and videos that I think you'll find informative, useful, inspiring, and perhaps even humorous.

As always, if you find something great, please send it to me.

- Dane

1) From cyberpunk to solarpunk: Technics and the cities of the future.

2) Turns out that Trader Joe was a real guy.

3) How do you determine if a project is serious?

via Chad Thomas, Director, Business Development - Iredell County, NC

4) How inflation became America’s greatest economic problem: The last time inflation was this high, the Fed engineered a severe recession. Unfortunately, the problem is much more complex now. Can the off-ramp to spiking inflation go better this time?

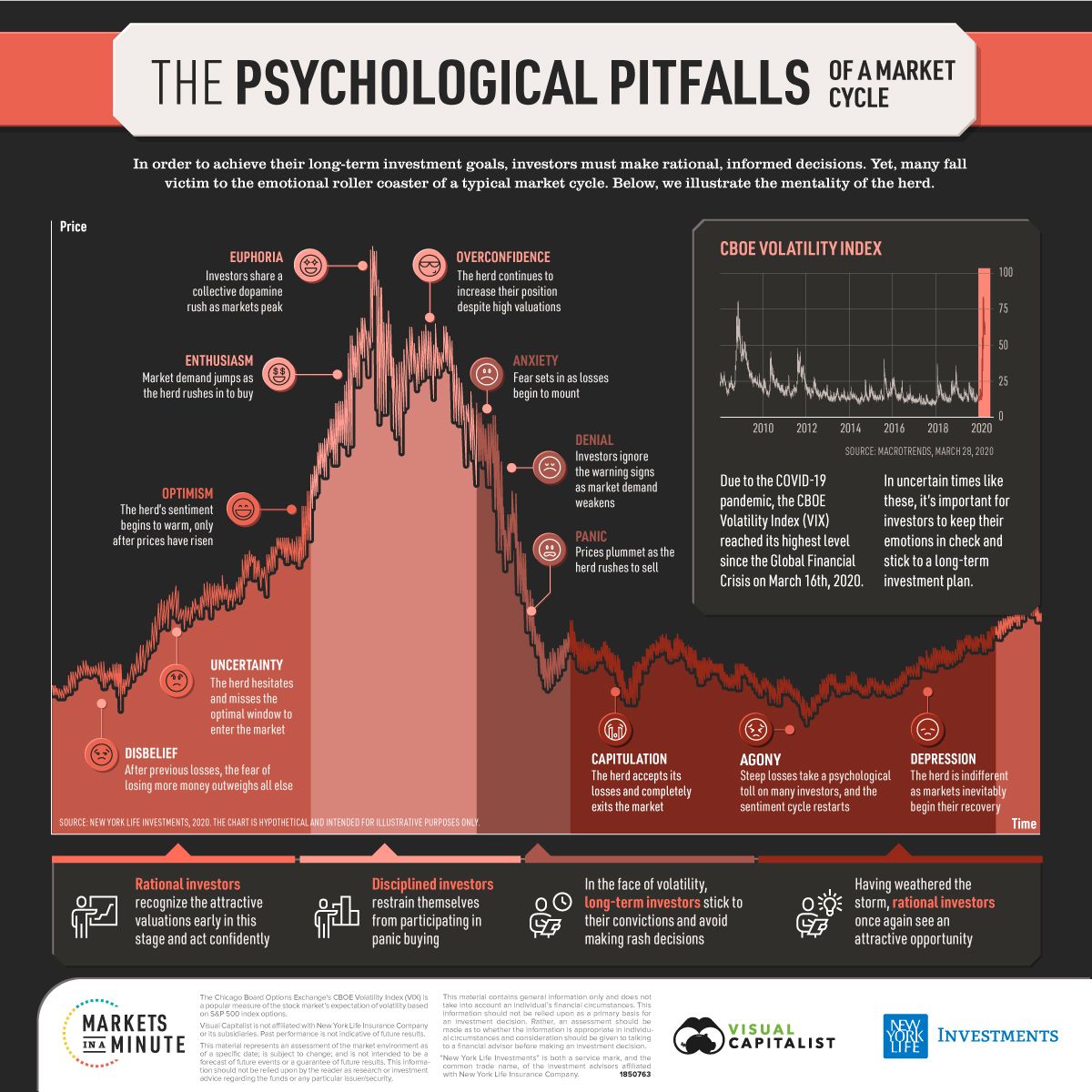

5) The psychological pitfalls of a market cycle:

6) Fed official says he doesn’t buy the ‘Great Resignation’ — employers play up labor shortage to avoid paying higher wages: Minneapolis Fed President Neel Kashkari said people are really leaving tough but important jobs for more attractive options.

7) 🇺🇸 War in Europe and China’s battle with Covid boosts US’s business appeal: For European companies, America offers political stability and sustained growth in an increasingly risky and turbulent world. Let the onshoring from Europe commence.

8) How America gave up on free markets:

In this Dean's Speaker Series, Thomas Philippon discusses his book, The Great Reversal: How America Gave Up on Free Markets, and the decline of competition in the United States.

9) Big business is overcharging you $5,000 a year: Consolidation is great for corporations — and bad for almost everyone else.

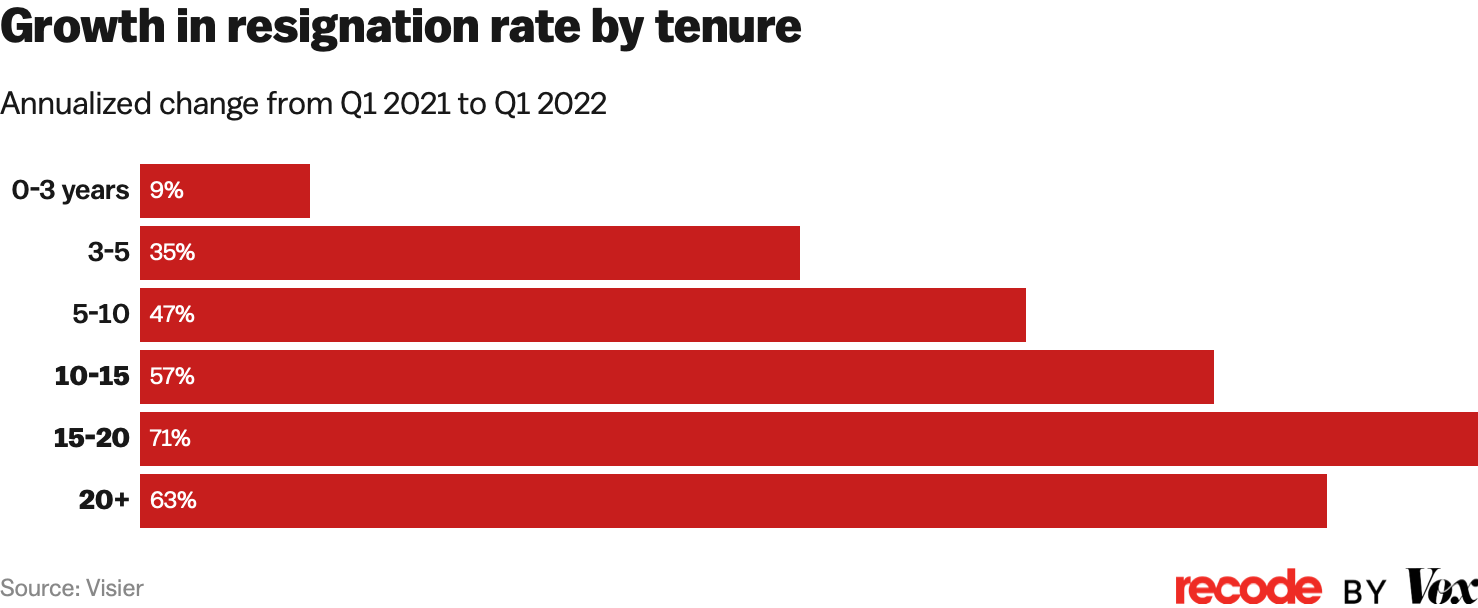

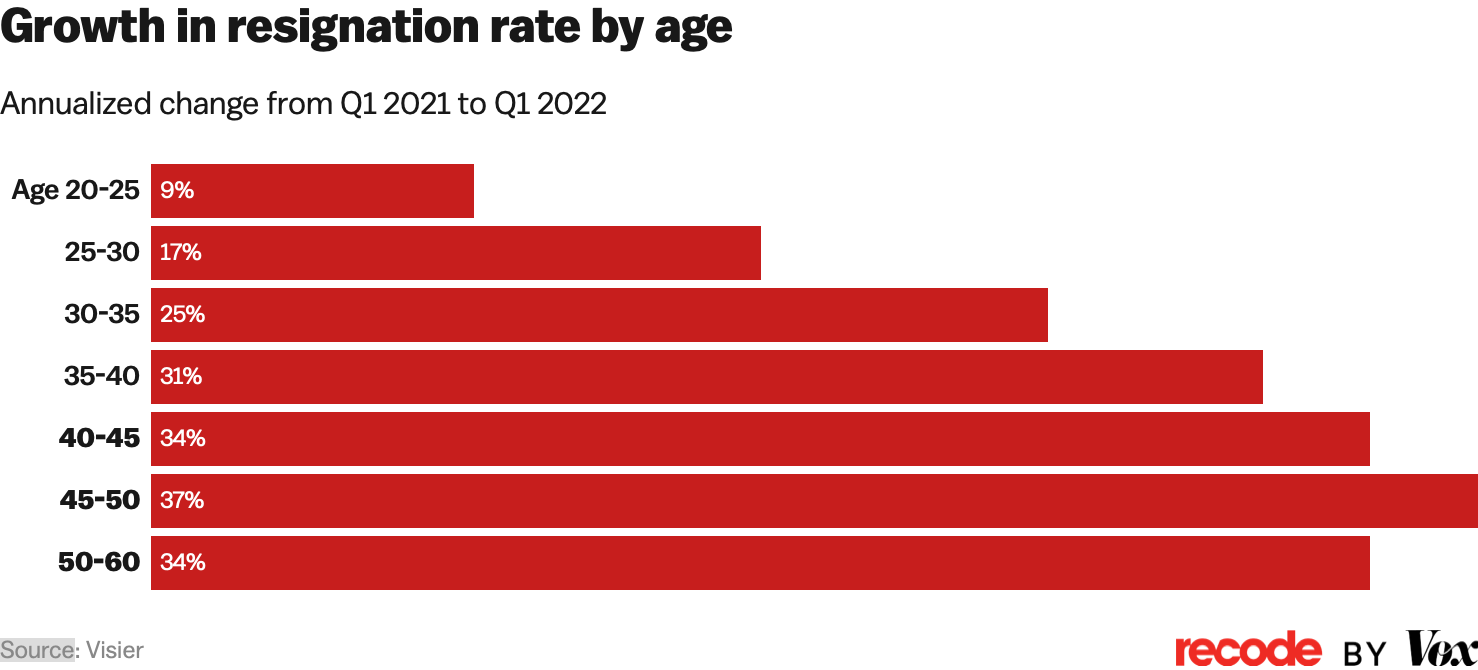

10) The Great Resignation is becoming a “great midlife crisis”: Older, more tenured people are increasingly quitting their jobs.

11) Highest inflation in America is punishing a Texas town and its residents: Midland, Texas, is used to booms and busts. But even here, prices are shocking the local economy — and the Fed may not be able to help.